Top 10 Insurance Product Configurator Softwares

-

by LeadSendby LeadSend

November 16, 2023

November 16, 2023

In the dynamic world of insurance, keeping up with the ever-changing demands and regulations can be a daunting task. That’s where insurance product configurators step in, like your tech-savvy partners, to simplify and streamline the complexities of product configuration.

Let’s delve into the top 10 insurance product configurators, each designed to make your insurance journey smoother and more efficient.

Criteria for Evaluation:

Choosing the right software that aligns with your business needs is crucial. Here are some factors to help you select the right Insurance Product Configurator software.

– User-Friendliness: Evaluate the software’s ease of use, ensuring that it facilitates a smooth configuration process without requiring much steep learning

– Scalability: Consider the scalability of the software, assessing its ability to grow and adapt to the changing needs of your insurance business.

– Integration Capabilities: Look for configurators that seamlessly integrate with your existing systems and other tools within your insurance workflow.

– Industry Compliance: Ensure that the software complies with industry regulations and standards, providing a secure and compliant environment for insurance product configuration.

Top 10 Insurance Product Configurator Software:

1. Pega

Pega emerges as a trusted companion, simplifying and streamlining the complexities of product customization. Imagine having a helpful friend who brings ease and adaptability to the often challenging task of crafting personalised insurance solutions.

With Pega by your side, you can effortlessly navigate market shifts, adhere to regulations, and cater to the unique needs of each customer.

Top Features:

– Streamlined Product Configuration

- Easy-to-use interface and drag-and-drop functionality

- Swift creation and modification of insurance policies

- Adaptability to evolving market demands and regulatory changes

– It enhances customer experience

- Personalized insurance offerings tailored to individual needs

- Real-time quoting for immediate and accurate pricing information

- Transparency and trust-building customer relationship

– Automates Compliance and Regulatory tasks efficiently

- Pre-built compliance rules and automated processes for risk mitigation

- Continuous monitoring of regulatory updates for proactive adaptation

- Compliance assurance throughout insurance operations

– Smooth Operations

- Pega’s smart automation streamlines insurance product configuration

- Efficient and error-free handling of product details

- Effortless product creation and modification processes

– Quick Adaptation to Rules

- Pega’s flexible system accommodates rapid regulatory changes

- Insurance products always adhere to the latest standards

- Ensures compliance and regulatory adherence throughout operations

Pros:

1. Pega’s flexibility makes you an insurance product configuration pro.

With Pega, you can effortlessly adapt to the ever-changing insurance landscape, tailoring products to meet market demands, regulatory requirements, and customer preferences.

2. Pega’s smart automation streamlines your workflow, making you an efficiency expert.

Say goodbye to time-consuming manual processes and costly errors because it’s automation takes the reins, ensuring smooth and efficient product configuration.

3. Pega empowers you to create customer-centric insurance products, making you a customer satisfaction champion.

It has a user-friendly interface and rapid customization capabilities that enable you to design products that perfectly match your customers’ needs, fostering loyalty and satisfaction.

Cons:

1. Pega’s advanced features might require a bit of training.

While it’s capabilities are extensive, they might initially seem daunting. Investing in training can help you unlock its full potential and become a product configuration wizard!

2. Pega’s initial and ongoing costs should be carefully considered, especially for smaller insurance companies.

Pega’s value is undeniable, but it’s important to weigh the costs against your company’s budget as well. Consider the potential long-term benefits before making an investment in this software.

2. Covergo

Creating customised products that meet the evolving needs of customers in the field of insurance can be challenging. That’s where Covergo steps in. Covergo – a no-code insurance product configuration platform simplifies the process, makes it more efficient, and helps you make informed decisions based on real data.

With Covergo’s configurable data models and real-time analytics, you can easily understand your insurance products, spot trends, and make strategic choices backed by insights. But it’s not just about simplifying things; it’s about making them better.

Covergo’s comprehensive toolset helps you tackle the challenges of insurance product customization, ensuring you can quickly create tailored solutions that meet customer needs while following regulations.

Key Features:

– Patented No-code Visual Product Builder:

- This feature empowers users with no coding experience to design and configure insurance products quickly and easily.

- This democratizes product development, allowing businesses to rapidly launch new offerings without relying on technical expertise.

- Unlike competitors with code-based product configuration, Covergo’s visual builder offers a user-friendly and intuitive interface, significantly reducing development time and cost.

– Comprehensive API Ecosystem:

- Covergo boasts over 500 APIs, enabling seamless integration with various third-party applications and systems.

- This extensive API ecosystem allows insurers to connect Covergo with existing CRM, accounting, claims processing, and other business tools.

- This fosters data flow automation, eliminates manual data entry, and provides a holistic view of operations, enhancing efficiency and data-driven decision-making.

– Unmatched Scalability and Flexibility:

- Covergo’s cloud-based architecture provides unmatched scalability, allowing insurers to adapt to changing business needs effortlessly.

- This eliminates the need for costly on-premises infrastructure and enables rapid scaling up or down to accommodate fluctuations in demand.

- Additionally, Covergo offers modularity, allowing insurers to configure the platform to their specific needs and preferences, maximizing its value and promoting customization

Pros:

– No-code product builder:

Empowering users to design and configure insurance products quickly and easily, without coding expertise. This democratizes product development and significantly reduces development time and cost.

– Comprehensive API ecosystem:

Over 500 APIs enable seamless integration with various third-party applications and systems, fostering data flow automation and eliminating manual data entry.

– Unmatched scalability and flexibility:

Cloud-based architecture allows for effortless adaptation to changing business needs and rapid scaling up or down. Additionally, modularity enables configuration to specific needs and preferences.

– Focus on omnichannel distribution:

Offers tools for reaching customers through online marketplaces, embedded insurance solutions, and direct sales platforms, expanding reach and market share.

Access CoverGo’s fully configurable admin platform. Here, set up automation workflows and management processes to streamline your business operations and team management. Customize the platform to align with your agency’s specific needs, ensuring that it serves as a tailored and efficient tool for your team.

Cons:

– Vendor Lock-in Potential:

- Reliance on Covergo for updates, support, and customization limits control over the platform’s development and future direction. This could hinderyour ability to adapt to changing needs or leverage alternative solutions.

- Carefully evaluate the vendor’s commitment to open standards and flexibility to avoid potential lock-in.

– Customization Limitations for Complex Needs:

- While its customizable, Covergo might not cater to highly complex insurance lines or unique business models requiring extensive modifications.

- Assess your specific needs and ensure Covergo’s capabilities align with your desired level of customization.

C2L Biz is definitely a trusted ally in the intricate world of insurance product creation, transforming complexity into simplicity with its “rule-base” configuration system.

This comprehensive tool empowers insurers to effortlessly create a wide range of insurance products, enhancing the customer experience and ensuring compliance.

It can navigate the complexities of product creation with confidence, streamlining processes and achieving accuracy, efficiency, and compliance.

Key Features:

– Single Configurator for Diverse Product Lines:

- Unlike other platforms that require separate configurators for different products, C2L Biz offers a single, unified configurator that can handle a wide range of insurance lines, including life, property & casualty, and health insurance.

- This eliminates the need for specialized configurators for each product, simplifying product management and reducing implementation costs.

– Ease of Packaging Various Sales Offerings:

- C2L Biz allows insurers to easily package various sales offerings within the same product, such as riders, add-ons, and coverages.

- This enables them to create more attractive and customizable product bundles, cater to diverse customer needs, and increase product sales.

– Product Versioning and Effective Date-based Rules:

- It offers product versioning capabilities, allowing insurers to maintain different versions of the same product for different customer segments or regulatory requirements.

- This flexibility enables them to quickly respond to market changes and comply with regulatory updates without disrupting existing product offerings.

Pros:

– Product Versioning and Effective Date-based Rules:

- Allows for quick response to market changes and regulatory updates without disrupting existing offerings.

- Ensures compliance with evolving regulations and facilitates product differentiation in a competitive market.

– Flexible Rule Engine for Validation and Calculations:

- Enables accurate product configuration, pricing, and underwriting decisions.

- Provides unparalleled flexibility to personalize products to specific customer segments and risk profiles.

– Sales Illustration and In-force Illustration as-a-Service:

- Increases transparency and customer understanding of product features and benefits, which helps in informed decision-making.

- Enhances customer experience and accelerates the sales process, that improves customer acquisition and retention.

Cons:

– Potential Learning Curve for Complex Configurator:

- The platform’s advanced features might require training and support for users unfamiliar with product configuration intricacies.

- Initial implementation could be time-consuming for larger organizations with complex product portfolios.

– Customization Requirements and Development Resources:

- Extensive customization might require additional development resources and expertise, potentially increasing implementation costs.

- Depending on the level of customization, ongoing maintenance and updates might also require dedicated resources.

4. Tigerlab

Tigerlabs is a tech-savvy companion, streamlining the complexities of insurance operations and empowering insurers to navigate the ever-changing landscape with confidence. Their software easily handles policy management, underwriting, and claims thanks to its connected tools that work together smoothly.

Key Features:

– Symphony of Interconnected Modules:

- Tigerlab’s software suite comprises interconnected modules covering the entire insurance lifecycle, from policy issuance and management to underwriting and claims handling.

- This integrated approach eliminates isolated systems and data duplication, leading to increased efficiency, improved data accuracy, and better decision-making.

– AI-powered Underwriting and Claims Processing:

- Tigerlab leverages AI algorithms to streamline underwriting processes, automate repetitive tasks, and expedite claims processing.

- This reduces manual work, improves turnaround times, and allows underwriters to focus on core business practicies..

Pros:

– Open API Ecosystem:

- Integrates with existing systems and third-party applications which helps in customizing the platform to specific needs.

- Improves data flow and automates workflows, and assist in enhancing operational efficiency.

– Strong Focus on Regulatory Compliance:

- Reduces compliance risks and ensures adherence to relevant regulations.

- Saves time and resources, allowing insurers to focus on core business operations.

– Omnichannel Customer Experience:

- Empowers customers with self-service options, enhancing convenience and accessibility.

- Improves customer engagement and satisfaction, leading to higher retention rates.

Cons:

– Potential for Feature Overlap with Existing Systems:

- Certain features might overlap with existing systems, leading to unnecessary redundancy.

- Carefully evaluate existing functionalities and avoid unnecessary duplication of features.

– Integration Challenges with Legacy Systems:

- Integrating Tigerlab with older systems could be complex and time-consuming.

- Assess compatibility and allocate resources to manage potential data migration challenges.

5. Insly

Insly is a game-changer in the insurance world, providing brokers with top-notch configurator tools that go beyond the ordinary. They’re like your personal insurance superheroes, crafting solutions that fit seamlessly into your unique broker journey.

Their comprehensive suite of solutions, including Insly BrokerFlow, Insly Product Builder, Insly Accounting and Reporting, and Insly Claims Management and Handling, meticulously tailors to the unique needs of each broker’s journey.

Key Features:

– Cloud-based and Scalable:

- Insly’s cloud-based architecture eliminates the need for expensive on-premises infrastructure and allows for seamless scalability to accommodate changing business needs.

- This provides insurers with greater flexibility and agility, enabling them to adapt quickly to market trends and growth opportunities.

– Simplified Policy Management and Issuance:

- Insly’s user-friendly interface and automated workflows streamline the policy management process, from quote generation and binding to policy issuance and renewals.

- This reduces manual work, improves operational efficiency, and minimizes errors.

– AI-powered Underwriting and Risk Assessment:

- Insly leverages AI algorithms to analyze data and assess risk profiles accurately, leading to faster underwriting decisions and improved risk selection.

- This enables insurers to offer competitive rates and reduce losses.

Pros:

– Broker-centric Approach:

Insly stands out by offering a suite of tools and features specifically designed for insurance brokers, exceeding the capabilities of most insurance software solutions in catering to their unique needs.

This focus on brokers provides several advantages:

- Enhanced broker productivity: Streamlined workflows, automation, and dedicated tools that empowers brokers to work more efficiently and effectively.

- Improved client service: Provides brokers with the tools and insights needed to deliver superior service and build stronger client relationships.

- Increased competitiveness: Enables brokers to differentiate themselves in the market by offering a unique value proposition and better client experience.

– Seamless User Interface and Navigation:

Insly’s user-friendly interface prioritizes intuitiveness and ease of use, minimizing the learning curve and simplifying user interactions

This user-centric design offers several advantages:

- Faster user adoption: Reduces training time and ensures users are productive quickly.

- Improved user satisfaction: Encourages engagement and enhances overall user experience.

- Reduced errors: This streamlines workflows and minimizes the risk of mistakes.

Cons:

– Scalability Limitations for Large Operations:

While Insly excels for brokers and smaller insurers, its scalability for handling large data volumes and complex workflows associated with extensive operations might be limited.

This can lead to several challenges:

- Performance bottlenecks: System performance might deteriorate with increasing data and user load, impacting efficiency and also the user experience.

- Integration difficulties: Integrating Insly with complex systems and managing multiple workflows can be challenging and resource-intensive.

- Customization requirements: Large insurers might require extensive customization and development efforts to tailor the platform to their specific needs, increasing costs and implementation time.

InsureSoft Configuration Tool is like a sculptor, carefully shaping every aspect of product configuration. The primary function of this tool is in product development – allowing insurance companies to design, create, and manage their products with ease and accuracy.

On the other hand, its interface puts complete control in the hands of business users, while reducing the need for IT involvement and streamlining the product development process as well!

Key Features:

– Adaptive Configuration:

InsureSoft’s tool dynamically tailors insurance products to evolving market demands, ensuring adaptability in a changing landscape.

– User-Friendly Interface:

The tool simplifies the configuration process with an intuitive design, making it accessible for efficient navigation.

– Integration Excellence:

Seamlessly integrating with existing insurance workflows, it ensures a smooth operational flow, enhancing overall efficiency

Pros:

– Precision in Configurations:

Ensures accuracy in tailoring insurance products, providing insurers with a tool for precise customization

– Efficiency Gains:

The user-friendly interface contributes to streamlined processes, making the configuration journey efficient and effective.

Cons:

– Learning Curve:

Like any robust tool, users may require initial familiarization, this is important for utilizing the tool’s full potential.

Seamless Insure is a cloud-based, no-code insurance product development software that helps insurers create, configure, and manage insurance products with ease. It provides a user-friendly drag-and-drop interface, real-time product previews, rules-based configuration, version control, and role-based security.

Most importantly – it enables insurers to reduce time to market, IT costs, and improve product agility and quality.

Key Features:

– Innovative Product Development:

The software fosters creativity and innovation in insurance product design, providing a platform for groundbreaking solutions.

– Real-Time Collaboration:

By enhancing team communication, the software ensures effective product development with seamless collaboration tools.

– Adaptable Configurations:

Allowing insurers to swiftly adapt to market changes, it offers flexible configurations, ensuring agility in response to evolving needs.

Pros:

– Industry Innovation:

Keeps insurers at the forefront of industry shifts, fostering continuous advancement.

– Efficient Collaboration:

Real-time collaboration tools foster effective teamwork, promoting a streamlined and collaborative work environment

Cons:

– Customization Complexity:

While offering adaptability, highly customized products may require additional efforts.

Fadata INSIS is an insurance software platform that helps insurers manage their business more efficiently. It is a cloud-based platform that can be deployed on-premises or in the cloud. INSIS provides a variety of features to help insurers automate processes, reduce costs, and improve customer satisfaction.

These features are unique because they include low-code product design and setup, automated business processes, a self-service portal, data integration capabilities, and a cloud-ready architecture.

Key Features:

– Low-code product design and setup:

- Design and configure insurance products without coding expertise, allowing for quicker time to market and greater flexibility.

- Business users can manage product configurations themselves, reducing dependence on IT resources and improving efficiency.

– Automated business processes:

- Automate repetitive tasks like underwriting, policy issuance, and claims processing, saving time and effort.

- Automation reduces manual errors and ensures consistent application of business rules.

– Self-service portal:

- Empower customers to manage their policies, submit claims, and access information online 24/7.

- Self-service options free up staff time for more complex tasks and customer interactions.

– Data integration:

- Integrate INSIS with other systems like CRM and accounting software to gain a comprehensive understanding of business performance and customer engagement.

- Leverage integrated data to make informed decisions about product development, marketing campaigns, and risk management.

– Cloud-ready architecture:

- Easily scale the platform up or down to meet changing business needs.

- Eliminate the need for on-premises hardware and software maintenance, lowering operational expenses.

– Multi-tenancy:

- Share infrastructure and resources with other insurers, making INSIS cost-effective even for smaller companies.

- Streamline product configuration and testing processes across multiple entities.

Pros:

– Data-Driven Decision-Making:

- Provides a holistic view of operations and customer behavior.

- Offer valuable insights for informed decision-making about product development, marketing strategies, and risk management.

- Built-in features help ensure compliance to relevant regulations and standards, reducing compliance costs

– Reduced Costs:

- Sharing infrastructure and resources with other insurers reduces deployment and maintenance costs.

- Cloud-based architecture minimizes IT overhead and associated costs.

- Reduces manual errors and rework, leading to cost savings in the long run.

Cons:

– Integration Challenges:

- Integrating INSIS with existing systems like CRM and accounting software might require additional effort and expertise.

- Potential compatibility issues with certain software could lead to operational disruptions and delays.

– Limited Support for International Markets:

- May not be as well-suited for insurers operating in multiple countries with different regulatory environments.

- Localization and compliance requirements might necessitate additional configuration and support.

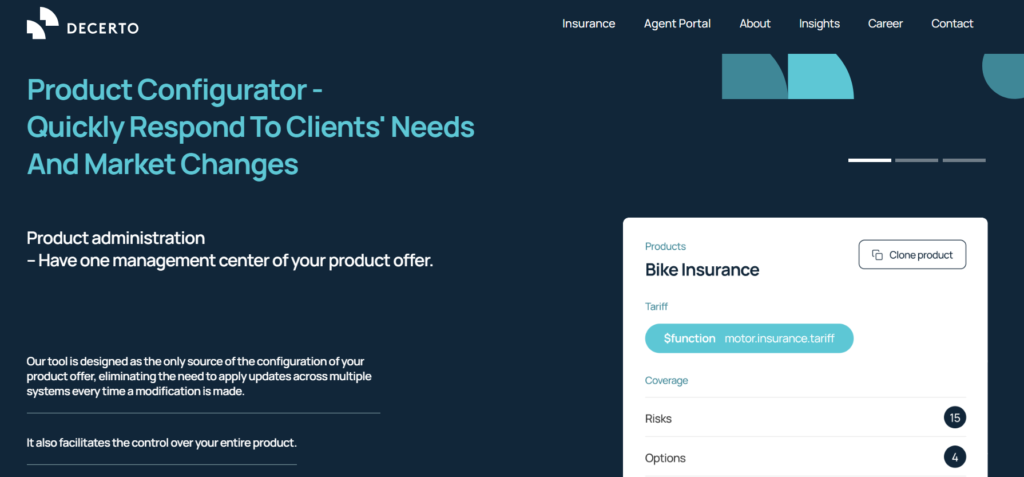

Imagine a one-stop shop for all your insurance software needs. That’s exactly what Decerto offers! They provide software and services to help insurance companies boost efficiency, improve customer experience, and grow their business.

Their flagship product, Hyperon, is like a Swiss army knife for insurance. It handles everything from policy administration and claims management to billing, all while being flexible and easy to customize.

Decerto doesn’t just focus on one type of insurance, either. They cater to both life and property & casualty insurance companies with specialized software solutions. They even help you move your data from your old system to their new one and can manage your IT infrastructure if you need it.

Key Features:

– Integration Capabilities:

- Hyperon integrates with other business systems, such as CRM, accounting, and document management software, to automate data flow and eliminate manual data entry.

- By connecting various systems through integrations, Decerto fosters a holistic view of your operations and facilitates real-time data exchange, leading to improved decision-making and efficiency.

– Hyperon

- Scalability: Built on a modern, cloud-based architecture that can scale up or down to accommodate changing business needs. This allows you to handle peak periods and future growth without infrastructure limitations.

- Low-code/No-code configuration: Designed to be easily customized by business users with limited technical expertise. This reduces dependence on IT resources and accelerates implementation time.

- Policy administration: Provides comprehensive functionality for managing policy lifecycles, from quotes and endorsements to cancellations and renewals. Features include product configuration, quoting tools, rating engines, and policy issuance capabilities.

- Claims management: Streamline the claims process with features like automated workflows, online claims reporting, document management, and integration with third-party adjusters.

Pros:

– Hyperon’s Low-code/No-code Configuration:

- Empowers business users without coding expertise to configure and customize the platform. This significantly reduces dependence on IT resources, accelerates implementation, and promotes business agility.

- Enables rapid prototyping and testing of new features and functionalities, accelerating innovation and responding quickly to market changes.

– Comprehensive Data Migration Services:

- Decerto offers a seamless data migration process with proven methodologies and tools. This minimizes disruption to your operations and ensures data integrity throughout the transition.

- They provide dedicated data migration specialists who work with you to plan, execute, and monitor the migration process, ensuring a smooth and successful transition.

Cons:

– Limited Customization for Highly Complex Needs:

- Although Hyperon is customizable, it might not be suitable for extremely complex insurance lines or unique business models requiring extensive customization.

- Additional development work may be necessary to adapt the platform to specific workflows and processes.

– Costly for Smaller Insurers:

- Initial investment and ongoing subscription fees might be high for small companies with limited budgets.

- Return on investment might be slower for smaller insurers with less complex needs.

10. EIS Suite

Picture a comprehensive software solution that empowers insurance companies to streamline their operations, elevate customer experiences, and explore new opportunities. That’s exactly what the EIS Suite delivers!

Built on a cloud-native platform, the EIS Suite offers scalability, agility, and effortless updates.

Its core components revolve around PolicyCore, ClaimCore, CustomerCore, and the EIS DXP, seamlessly managing the entire insurance lifecycle, from quoting and underwriting to claim processing and customer engagement.

The “Low-code configuration” empowers insurers to customize and build products without extensive coding, while AI and machine learning automate tasks, analyze data, and deliver valuable insights.

Key Features:

– Policy Management:

- Get quotes and create policies quickly and easily, all from one place.

- Customize your insurance products to meet the specific needs of your customers.

- Automate repetitive tasks, such as renewals and endorsements, to save time and money

– Claims Processing:

- File, manage, and resolve claims efficiently.

- EIS understands that receiving claim payments quickly and accurately is important to their customers. That’s why they prioritize fast and efficient claim processing.

- With this software, you can provide your customers with a better claims experience.

– Customer Management:

- Give your customers 24/7 access to their policy information and account details.

- Tailor your communications to your customers’ individual needs.

- Build stronger relationships with your customers.

– Digital-First:

- Access your data and applications from anywhere, anytime.

- Manage your business on the go with our mobile app.

- Integrate with other systems you use, such as your CRM and accounting software.

– Low-Code Configuration:

- Easily customize the EIS Suite to meet your specific needs without the need for coding expertise.

- Get your product up and running quickly with our user-friendly interface.

- Spend less time on IT intricasies and more time on your business.

Pros:

– Cloud-based and low-code:

- Access the platform from any device with internet access, and scale up or down as your needs evolve. No need for expensive hardware investments.

- No coding expertise required to personalize the platform and start using it quickly. This saves time and resources compared to traditional software solutions.

– Mobile-friendly and self-service options:

- Customers can manage their policies, file claims, and access information on the go using their mobile devices. This enhances convenience and satisfaction.

- Self-service options empower customers to handle basic tasks themselves, freeing up staff time for more complex inquiries and activities.

– Automated tasks and streamlined processes:

- Automate repetitive tasks like policy renewals and claims processing, freeing up staff time for more strategic initiatives.

- Automation minimizes manual effort and human error, leading to more accurate and efficient operations.

– Personalized experiences and data-driven insights:

- AI-powered features analyze customer data to gain insights into their needs and preferences. This enables personalized interactions and product recommendations.

- Data-driven insights provide valuable information to inform business decisions, leading to better risk assessment, product development, and resource allocation.

– Modular and cost-effective:

- Choose only the modules you require, avoiding unnecessary costs. This is particularly beneficial for smaller insurers with specific needs.

- Cloud-based deployment eliminates the need for on-premises hardware and software maintenance, saving costs and resources.

Cons:

– Limited customization:

- May not be suitable for highly complex needs. The platform’s pre-built functionality might not be sufficient for unique business models or highly specialized insurance lines.

- You might get difficulties to adapt to specific workflows. Customization options might be limited compared to more established platforms, potentially requiring additional development work.

– Emerging platform:

- The EIS Suite is a relatively new platform compared to some competitors. This means less historical data and user experience feedback available.

- It’s important to consider the platform’s future development and support as the company evolves.

– Integration challenges:

- Integrating the EIS Suite with existing systems like CRM and accounting software might require additional effort and expertise.

- Ensure compatibility with your existing software environment to avoid technical obstacles.

– Vendor dependence:

- You are reliant on the EIS Group for updates and support. Any technical issues, bugs, or feature requests depend solely on EIS Group’s responsiveness and development roadmap.

- Moreover, users have less control over the platform’s development compared to open-source or customizable solutions.

Wrapping Up:

In the intricate world of insurance, product configuration often becomes a daunting maze of rules, regulations, and diverse customer needs. Navigating this complex process requires dependable companions, and these top insuranceconfigurator softwares we’ve explored emerge as valuable partners. .

Instead of complicated technology solutions, consider these powerful tools that simplify insurance operations. They help insurers adapt to changing markets, regulations, and customer needs. Choose the software that best aligns with your business goals for greater efficiency and clarity.