8 Best Insurance Claim Softwares

-

by LeadSendby LeadSend

November 16, 2023

November 16, 2023

In the dynamic insurance industry, efficient claim management is crucial for both insurers and policyholders. The right software can make all the difference, streamlining processes, enhancing client experiences, and optimizing data-driven decision-making.

Let’s dive into the top 8 insurance claim software solutions that can significantly improve your claims management process.

Guidewire’s claims management software distinguishes itself with its user-friendly interface and high configurability. It seamlessly integrates digital claims intake, fraud detection, and analytics, making it a versatile choice for insurance companies looking to enhance their claims processes.

Top Features:

User-Friendly Interface: Guidewire’s software ensures a smooth user experience, minimizing the learning curve for staff.

Configurability: The software adapts to the unique needs of each insurance provider, offering a tailored solution.

Digital Claims Intake: Streamlining the process, Guidewire enables digital claims submission, reducing paperwork and improving efficiency.

Fraud Detection: Guidewire incorporates robust fraud detection mechanisms to safeguard against fraudulent claims.

Analytics: The software provides advanced analytics tools, offering insights that can inform strategic decision-making.

Pros and Cons:

Pros:

- Highly configurable to meet diverse needs.

- User-friendly interface enhances staff efficiency.

- Comprehensive fraud detection mechanisms.

- Advanced analytics for data-driven decision-making.

Cons:

- May require time-consuming training for full utilization of advance technical features.

- Configurability might be complex for users without technical backgrounds.

Duck Greek Technologies stands out with its comprehensive suite of insurance software solutions, and its Claims Management system is no exception. With a focus on streamlining the claims processes, automating tasks, and enhancing customer experiences, Duck Greek is a go-to choice for insurers seeking efficiency and effectiveness.

Features:

Comprehensive Suite: Duck Greek offers a holistic suite of insurance solutions, ensuring a seamless integration of claims management with other critical aspects.

Automation: The Claims solution automates repetitive tasks, reducing manual intervention and accelerating the claims processing timeline.

Customer Experience: With a user-centric design, Duck Greek enhances customer experiences by providing real-time updates and a transparent claims journey.

Mobile Claims Tracking: Duck Creek’s Claims solution includes a mobile app (Prompt.io) for policyholders to track and manage their claims on the go.

Predictive Analytics: Utilizes predictive analytics to assess and predict potential fraudulent claims, enhancing risk management.

Pros and Cons:

Pros:

- Comprehensive suite for end-to-end insurance management.

- Automation improves efficiency and reduces processing time.

- Enhances customer satisfaction through transparent and streamlined claims processes.

Cons:

- Initial implementation may be challenging for some organizations.

- Extensive customization options may overwhelm smaller insurers.

Sapiens takes a holistic approach, covering all aspects of insurance, including claims. Their digital claims platform is designed to help insurers cut costs by enhancing the claims management process, making it a reliable choice in the competitive landscape.

Features

End-to-End Coverage: Sapiens provides a complete solution for insurers, ensuring a seamless integration of claims management with other insurance processes.

Cost Reduction: The digital claims platform focuses on efficiency, reducing operational costs through automation and streamlined workflows.

Customer Service: Sapiens emphasizes improving customer service with a user-friendly interface and transparent communication channels.

AI-driven Chatbot: Integrates an AI-driven chatbot for instant customer support and claim status inquiries.

Blockchain Integration: Utilizes blockchain technology for secure and transparent claims processing.

Pros and Cons:

Pros

- Comprehensive coverage across insurance processes.

- Cost-effective solution with a focus on efficiency.

- Chatbot for quick customer supports and claims redemption.

Cons:

- Some users may find the interface complex initially.

- Blockchain integration may pose challenges for some users.

Insurity’s ClaimsXPress is renowned for its robust claims processing capabilities, offering automated workflows and integrated analytics for data-driven decision-making. This software is a reliable choice for insurers looking for a powerful tool to optimize their claims management.

Features:

Robust Claims Processing: ClaimsXPress is equipped with advanced features to streamline claims processing, reducing errors and delays.

Automated Workflows: The software automates repetitive tasks, ensuring a smooth and efficient claims journey.

Integrated Analytics: Insurity integrates analytics for informed decision-making, providing actionable insights to insurers.

Mobile Damage Assessment: ClaimsXPress includes a mobile feature allowing adjusters to assess on-site damages using mobile devices.

Integration with IoT Devices: Utilizes IoT devices for real-time data collection, improving claims processing accuracy.

Pros and Cons:

Pros:

- Robust claims processing capabilities.

- Automation improves efficiency and reduces manual errors.

- Integrated analytics for data-driven decision-making.

Cons:

- Initial setup and configuration may require expertise.

- Comprehensive features may be overwhelming for small insurers.

FINEOS specializes in providing a claims management system for life, accident, and health insurance. The platform focuses on streamlining claims processing and enhancing the overall customer experience to ensure instant claims redemption.

Features:

Tailored for Life, Accident, and Health Insurance: FINEOS Claims caters specifically to the unique requirements of life, accident, and health insurance, ensuring a specialized approach.

Streamlined Claims Processing: The platform prioritizes efficiency, reducing processing time and improving the accuracy of claims management.

Customer-Centric Design: FINEOS places a strong emphasis on the customer experience, with features that enhance satisfaction and engagement.

Automated Underwriting: FINEOS Claims integrates automated underwriting processes for quicker policy evaluation.

Telehealth Integration: Specifically designed for health insurance, it includes telehealth integration for smoother health-related claims.

Pros and Cons:

Pros:

- Specialized for life, accident, and health insurance.

- Efficient transaction for health insurance claims.

- Customer-centric design improves overall satisfaction.

Cons:

- Customization for other insurance types may be limited.

- Premium pricing may not be suitable for small firms.

Origami Risk offers a cloud-based claims management solution known for its high configurability. Suitable for various types of insurance, it provides robust reporting and analytics features, making it a versatile choice for insurers seeking advanced and comprehensive data insights.

Features:

Cloud-Based Solution: Origami Risk’s cloud-based approach ensures accessibility and flexibility for insurers, allowing remote access to claims data.

High Configurability: The platform offers extensive customization options, adapting to the unique needs of different insurance providers.

Reporting and Analytics: Origami Risk provides robust reporting and analytics features, empowering insurers with actionable insights.

Machine Learning Algorithms: Utilizes machine learning algorithms for advanced risk assessment and claims predictions.

Real-time Collaboration Hub: Offers a collaborative hub for insurers, brokers, and clients for real-time updates and communication.

Pros and Cons:

Pros:

- Cloud-based accessibility for remote management.

- Centralized Communicationf or Insurers, brokers and clients

- Strong reporting and analytics capabilities.

Cons:

- Extensive configurability may be overwhelming for some users.

- ML algorithm may necessitate tech expertise.

- Premium pricing may be a barrier for smaller firms.

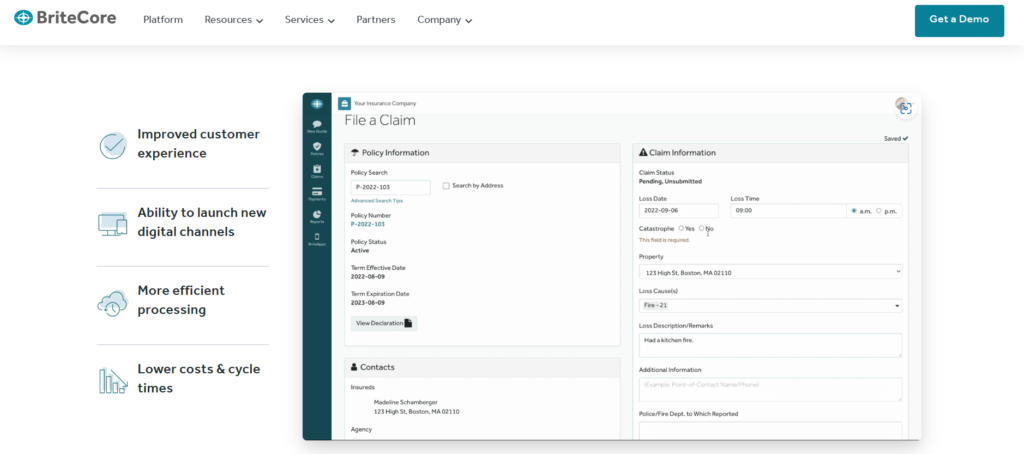

BriteCore Claims is a robust claims management solution designed to optimize the claims processing journey for insurers. Known for its modern interface and advanced features, BriteCore is a top choice for those seeking a contemporary and efficient solution.

Features:

Modern Interface: BriteCore Claims features a user-friendly and modern interface, enhancing the overall user experience for claims handlers and administrators.

Automation: The platform incorporates automation to streamline routine tasks, reducing manual effort and accelerating claims processing.

Integration Capabilities: BriteCore seamlessly integrates with other insurance processes, ensuring a cohesive and interconnected insurance ecosystem.

AI-Powered Analytics: BriteCore integrates AI-powered analytics for predictive insights, enabling data-driven decision-making.

Mobile App for Policyholders: Includes a mobile app that allows policyholders to initiate and track their claims conveniently.

Pros and Cons:

Pros:

- Modern and user-friendly interface.

- Automation improves efficiency.

- Seamless integration with other insurance processes.

Cons:

- Some users may require training for full utilization.

- Advanced features may require adaptation for smaller insurers.

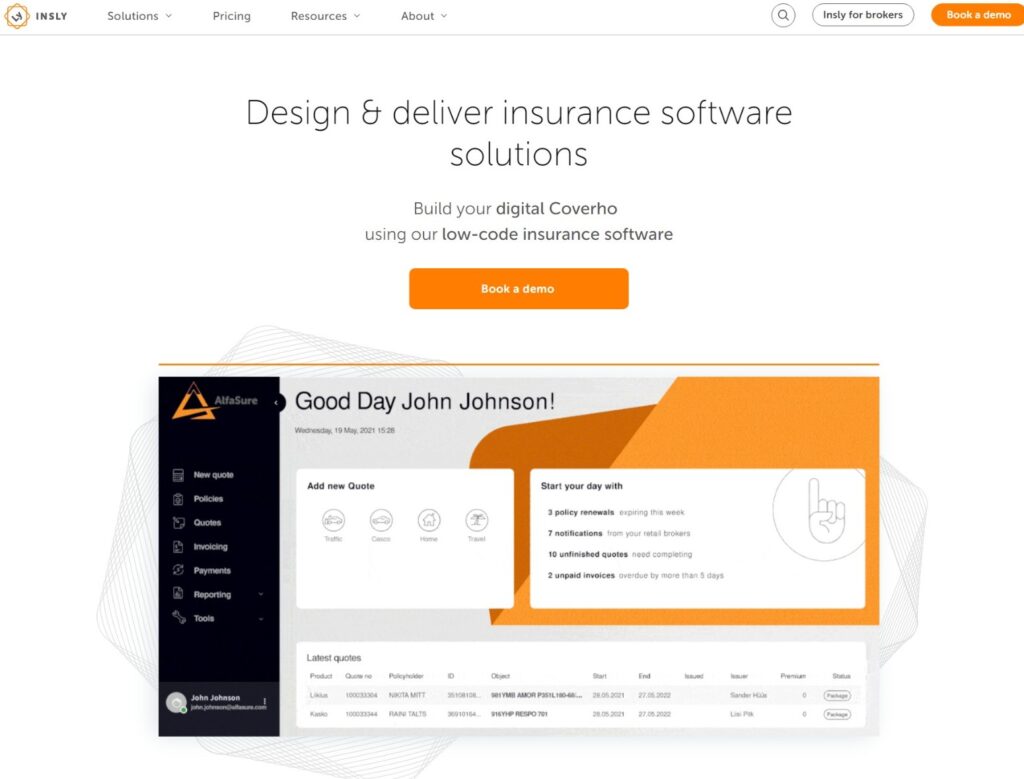

Insly offers a comprehensive insurance software solution that includes robust claims management capabilities. Targeted at insurance brokers and agents, Insly streamlines the claims process, enhances communication, and provides a centralized platform for managing policies and claims.

Features:

Broker and Agent Focus: Insly caters specifically to insurance brokers and agents, providing integrations that align with their unique needs in claims management.

Communication Enhancement: The platform emphasizes transparent communication channels, facilitating efficient interactions between insurers, brokers, and clients.

Centralized Platform: Insly provides a centralized platform for managing policies and claims, simplifying overall insurance operations.

Claims Dashboard for Brokers: Provides a specialized claims dashboard for brokers, offering a comprehensive overview of their clients’ claims.

Document Management System: Insly incorporates a document management system for efficient handling and organization of claim-related documents.

Pros and Cons:

Pros:

- Tailored for insurance brokers and agents.

- Centralized platform for streamlined operations.

- Effective claim documents management for insurers

Cons:

- Training may be required for non-analysts.

- Customization options may be limited for some specific needs.

Wrapping up:

These software solutions can transform your claims management process and elevate your operational efficiency. All the 8 Insurance claims softwares — Guidewire, Duck Creek Technologies, Sapiens, Insurity, FINEOS, Origami Risk, BriteCore, and Insly—offer diverse strengths. From user-friendly interfaces to AI-driven analytics, you can choose based on your unique needs and preferences.