How to use HubSpot for Insurance Agencies?

-

by LeadSendby LeadSend

November 16, 2023

November 16, 2023

The U.S. insurance market is highly competitive, with premiums exceeding $1 trillion. To stand out, insurance brokers and agents need to be efficient and effective. A CRM solution like HubSpot allows you to focus on customer needs, offer exceptional experiences, and resolve claims quickly. HubSpot streamlines the entire insurance workflow, eliminating manual data entry and the need for physical case folders.

Over 91% of companies with more than ten employees use CRM systems. If your insurance agency falls within that range, adopting a CRM system can keep you ahead of the curve. Instead of spending fortunes on advertising, use CRM software to engage prospects reliably.

Now let’s explore the methods and approaches that can help insurance companies become more successful, engaged, and efficient.

HubSpot’s CRM provides a centralized database for storing and managing customer data. Insurance companies can use it to keep track of policy details, contact information, communication history, and any other relevant data.

By maintaining detailed customer profiles, agents can provide personalized service and targeted communications, enhancing the overall customer experience. You can easily organize, automate, and generate reports on data associated with custom objects.

The CRM’s segmentation capabilities allow organizations to segment clients based on various criteria such as policy type, location, age, or any other pertinent factor. This segmentation enables more targeted marketing and outreach efforts.

Top Features of Hubspot:

– Analytics & Reporting Solutions:

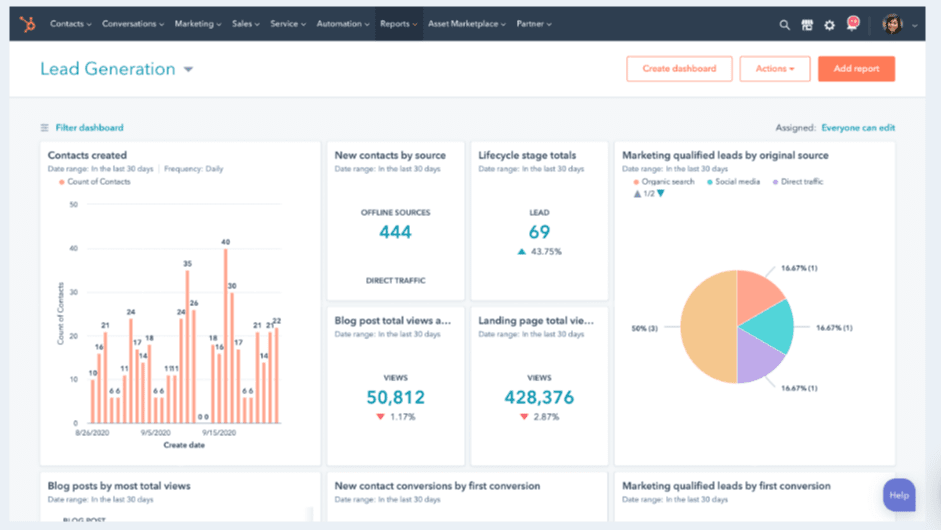

HubSpot provides robust reporting and analytics tools for insurance agencies to measure the effectiveness of their marketing and sales efforts.

Agencies can track key metrics such as website traffic, lead conversion rates, email open and click-through rates, and customer acquisition cost.

By analyzing these metrics, organizations can identify areas for improvement and enhance their strategies to achieve better results.

– Customer Service and Support:

HubSpot’s ticketing system allows insurance agencies to efficiently manage customer inquiries, support requests, and claims.

Customers can schedule meetings at their convenience, and agents can track the status of tickets, assign them to team members, and communicate with clients through a centralized platform.

By providing timely and personalized support, agencies can enhance client satisfaction and loyalty, ultimately leading to higher retention rates and referrals.

– Integration with Other Tools:

HubSpot offers integrations with a wide range of third-party tools and platforms commonly used by insurance organizations, such as quoting software, document management systems, and accounting software. These integrations enable seamless data flow between different systems, streamlining workflows and reducing manual data entry.

– Sales Pipeline Management:

HubSpot’s sales pipeline management features allow organizations to track the progress of leads and opportunities from initial contact to policy issuance.

Agents can create custom pipeline stages to reflect their business process and move leads through the pipeline efficiently.

Tasks, reminders, and notifications can be set up to ensure that leads are followed up promptly and opportunities are not overlooked.

– Universal Inbox:

Unite your channels and teams with a central inbox. Save time on email threads by using personal, team, or round-robin meeting links.

View, manage, and reply to all conversations from live chat, bots, or team email aliases in one place.

Insurance Marketing Automation:

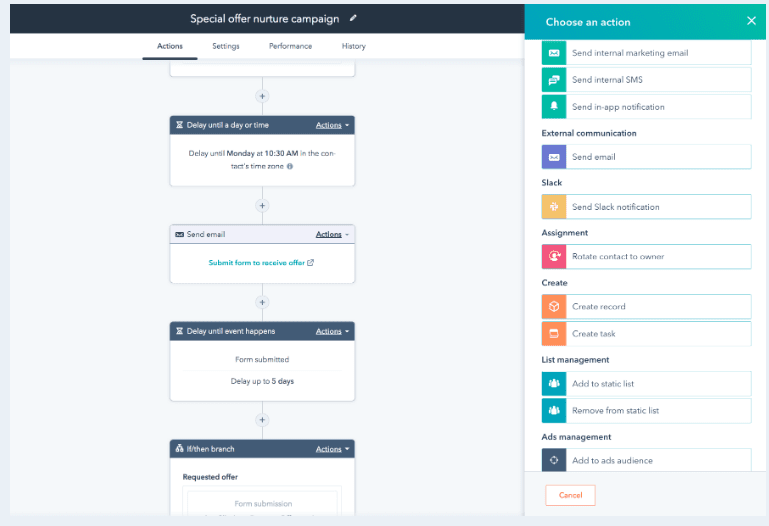

Insurance companies can use HubSpot’s marketing automation tools to create personalized and timely communications with clients and prospects.

Email marketing templates and sequences can be set up to nurture leads through the sales funnel, providing them with relevant information and offers at each stage of their journey.

For example, workflows can be created to send welcome messages to new leads, follow-up emails after a quote request, or renewal reminders. Social media integrations facilitate multichannel campaigns, streamlining sales and marketing processes.

HubSpot’s content management system (CMS) enables insurance agencies to create and publish valuable content that educates and engages their target audience. Agencies can produce blog posts, articles, guides, infographics, and other content that addresses common insurance questions, industry trends, and customer pain points.

By optimizing content for search engines (SEO) and promoting it through various channels, agencies can attract organic traffic to their website and generate leads. Personalized content, calls to action (CTAs), dynamic forms, and landing page performance analysis are also facilitated.

Optimize Lead Generation

HubSpot offers tools for lead generation forms and landing pages that seamlessly integrate with the CRM. Integration with services like Salesforce and Google Analytics is also possible.

You can use these forms and pages to capture contact information from website visitors interested in learning more about insurance products or requesting a quote.

By analyzing the performance of different forms and pages, agencies can refine their lead generation strategies to improve conversion rates and acquire more qualified leads.

How to use HubSpot:

Before you log off, See how to use HubSpot in seconds:

1. Set Up Your HubSpot Account:

- Visit the HubSpot website and sign up for an account.

- Choose the appropriate plan (free or premium) based on your agency management system.

2. Customize Your Dashboard:

- Once you are logged in, customize your dashboard by adding relevant widgets and tools.

- Create pipelines for leads, clients, and claims.

3. Import Your Contacts:

- Import your existing client database into HubSpot.

- Organize contacts by creating lists based on criteria such as policy type, renewal dates, etc.

4. Create Custom Properties:

- Customize properties (fields) to capture essential information about clients.

- Examples: Policy type, renewal date, premium amount, etc.

5. Automate Workflows:

- Set up automated workflows for lead nurturing, follow-ups, and claims processing.

- For example, automatically send a follow-up email after a client inquiry.

6. Track Interactions:

- Log all interactions with clients, including calls, emails, and meetings.

- Use the CRM to keep a comprehensive record of each client’s history.

7. Manage Leads and Opportunities:

- Create lead records for potential clients.

- As leads progress, convert them into opportunities (potential policies).

- Assign opportunities to specific agents.

8. Monitor Analytics:

- Use HubSpot’s analytics tools to track performance metrics.

- Monitor conversion rates, lead sources, and client engagement.

9. Integrate with Other Tools:

- Integrate HubSpot with your email client, calendar, and other essential tools.

- Sync data seamlessly across platforms.

10. Collaborate with Your Team:

- Share information within your agency.

- Assign tasks, set reminders, and collaborate on client management

Final Words:

Keep in mind that HubSpot offers flexibility, allowing you to adapt it to your agency’s specific needs. Regularly assess and refine your workflows to ensure optimal efficiency.

Leveraging HubSpot’s CRM, marketing tools, and other capabilities can help your agency succeed in today’s digital landscape. Embrace the potential of HubSpot to enhance productivity, client engagement, and business growth.