Top 10 Insurance Analytics Software

-

by LeadSendby LeadSend

November 16, 2023

November 16, 2023

In the ever-shifting tides of the insurance world, agility and insightful decision-making are the new anchors. You no longer need to rely solely on intuition; data, wielded wisely, is now your compass. Insurance analytics software steps in, not just as a navigational tool, but as a full-fledged engine, propelling you towards optimized operations and streamlined success.

Gone are the days of manual calculations and passive strategies. Today, business intelligence crunches vast data sets, uncovering hidden patterns and predicting future trends. From identifying fraud with laser precision to crafting personalized customer experiences, these solutions are revolutionizing every aspect of the insurance journey. And with a plethora of options available, choosing the right software can feel like steering through a choppy sea.

This blog is your map, charting the top 10 insurance analytics software options. We’ll dive deep into their functionalities, strengths, and target audiences, helping you identify the perfect software fit for your business.

Tableau Insurance Analytics empowers insurance companies to harness the power of data for informed decision-making and enhanced business outcomes. This specialized visual analytics platform offers a comprehensive toolkit for unlocking valuable insights from vast datasets, helping you to anticipate trends, optimize operations, and deliver personalized customer experiences.

What makes it standout?

1. Pre-built dashboards with industry expertise:

Forget starting from scratch. Tableau provides a library of ready-to-use dashboards specifically designed for insurance concerns, covering claims analysis, policy trends, and fraud detection. You’re not just handed data; you’re given a tailored roadmap to navigate it.

2. Visual storytelling like no other:

Tableau’s drag-and-drop interface isn’t just about convenience; it’s about unleashing your inner data storyteller. You can craft Craft eye-catching visualizations that transform complex statistics into impactful narratives, captivating anyone from actuaries to C-suite executives.

3. Advanced analytics at your fingertips:

Diving deeper than surface-level trends? Tableau’s got you covered. Predictive modeling, anomaly detection, and clustering capabilities unlock hidden patterns and predictive insights, letting you anticipate claims surges, identify potential fraud rings, and optimize pricing models with precision.

4. Democratizing data for all:

Forget data silos and departmental isolation. Tableau’s intuitive interface removes the need for extensive coding or data science expertise. With this, everyone in your organization, from underwriters to marketing teams, can access and analyze critical information.

Guidewire breaks the conventional boundaries of insurance software. It seamlessly integrates with your existing Guidewire core systems, creating a unified platform for data management, analysis, and action. This holistic approach enables you to harness the power of information across all operational domains, driving strategic decision-making and propelling your business towards exceptional performance.

Whether you’re navigating risk selection, streamlining claims, or crafting personalized customer experiences, Guidewire Analytics stands as your trusted partner in every aspect of data-driven excellence. This suite empowers you to unlock the full potential of your insurance operations, optimize every step of the customer journey, and confidently navigate the dynamic landscape of the insurance industry.

Some highlighting features:

1. Embedded Analytics:

Forget data silos and disjointed insights. Guidewire Analytics seamlessly integrates with your existing Guidewire core systems, creating a single, unified platform for data management, analysis, and action. This tight integration eliminates data transfer hassles and ensures real-time visibility across all operational domains.

2. Predictive Powerhouse:

Beyond static dashboards, Guidewire Analytics leverages cutting-edge machine learning and predictive modeling to forecast trends, anticipate risks, and proactively adjust strategies. This predictive intelligence helps you optimize pricing, minimize potential losses, and deliver personalized experiences before customers even ask.

3. Actionable Insights at Your Fingertips:

Guideware Analytics isn’t just about generating reports; it’s about driving action. Pre-built workflows and automated triggers translate insights into tangible actions, streamlining processes, enhancing efficiency, and minimizing manual intervention.

SAS Insurance Analytics rises as your comprehensive solution, transforming information into actionable intelligence. Beyond mere visualization, it empowers you to proactively assess risk with AI, streamline claims management with automation, craft personalized customer experiences, and conquer regulatory compliance with confidence. This multifaceted toolbox, backed by SAS expertise and scalable for future growth, is your strategic partner for data-driven certainty and sustained success.

Standout Features:

1. The Power of AI and Machine Learning:

SAS isn’t just about crunching numbers; it leverages cutting-edge artificial intelligence and machine learning algorithms to reveal deeper insights and predictive capabilities. It predicts claims surges before they happen, identifies hidden fraud rings with laser precision, and optimizes pricing models with unmatched accuracy, leaving other softwares in the dust.

2. Granular Claims Mastery:

Go beyond basic claims management. SAS drills down to granular detail, equipping adjusters with real-time insights into individual claims, automating workflows, and suggesting faster, more efficient resolutions. This level of precision surpasses standard solutions, boosting both customer satisfaction and bottom-line gains.

3. Hyper-Personalized Customer Journeys:

You no longer have to follow the one-size-fits-all approach. SAS reveals the secrets of policyholder behavior with granular data analysis. Craft personalized products, services, and communications specifically for individual needs and preferences. This laser focus on personalization outshines competitors, fostering loyalty and driving market differentiation.

4. Compliance Confidence, Simplified:

Regulatory challenges? SAS has your back. Its built-in compliance management systems simplify the process, ensuring accurate and auditable reporting. It mitigates risk and safeguards your reputation. This integrated approach surpasses basic compliance offerings, freeing you to focus on your core business activities.

4. Quantemplate

Quantemplate flips the script, automating tedious tasks and transforming data into your secret weapon. It’s a cloud-based platform specifically designed for automating and streamlining insurance data workflows. Say goodbye to manual drudgery. Quantemplate maps validates, and reconcile data seamlessly, leaving you with a clean, central hub of actionable insights.

You can dive deeper with pre-built reports and AI-powered analytics which spots trends, optimize pricing, and outsmart fraud. This no-code, cloud-based software scales with you, empowering every team member to become a data expert.

Top Features:

1. Machine Learning Mastery:

Forget static data mapping. Quantemplate’s AI engine learns from your past decisions, automatically mapping new data sources with ever-increasing accuracy, unlike pre-programmed tools that quickly become outdated.

2. Insurance DNA in Every Byte:

Quantemplate isn’t just another software; it’s fluent in insurance. Pre-built functionalities for bordereaux analysis, exposure management, and program performance eliminate the need for custom configuration, unlike generic analytics tools that require extensive adaptation.

3. Collaboration, Not Data Silos:

No more scattered data lakes. Quantemplate centralizes and standardizes data from diverse sources, fostering cross-functional collaboration and shared insights, a stark contrast to tools that leave departments struggling with fragmented views.

4. Actionable Insights, Not Data Overwhelm:

Pre-built reports and dashboards cut through the data noise, showcasing key trends and performance metrics in visually captivating formats. Say goodbye to endless spreadsheets and hello to insights that inspire immediate action.

Iris Software emerges as your strategic ally, transforming raw information into actionable intelligence and propelling your business operations toward data-driven victory.

No more drowning in scattered data lakes. Iris centralizes and streamlines insurance processes, from claims management to customer experiences, eliminating inefficiencies and fostering cross-functional collaboration. Pre-built dashboards and reports shed light on hidden trends and metrics, empowering informed decision-making at every level.

Leverage AI and machine learning to outsmart risk and optimize pricing. Iris anticipates claims surges, detects hidden fraud patterns, and personalized customer journeys with remarkable precision. This industry-specific expertise, sets Iris apart from generic analytics tools.

What makes it standout?

1. Risk Outsmarting, Not Risk Management:

Move beyond reactive strategies. Iris’s AI engine anticipates claims surges, flags potential fraud rings before they strike, and helps proactively manage risk with unparalleled accuracy, leaving other tools in the dust.

2. Built for Insurance, Not Adapted to It:

Unlike generic analytics platforms, Iris speaks the language of insurance. Its features are pre-configured for common insurance workflows and metrics, eliminating the need for extensive customization and saving you valuable time.

3. Democratizing Data for Everyone:

Technical expertise? Not required. Iris’s intuitive interface empowers everyone, from actuaries to marketing executives, to access and analyze data, democratizing insights and driving data-driven decisions across the organization.

4. Scalability, Your Data Growth’s Ally:

Is your data volume exploding? Iris scales seamlessly, adapting effortlessly to your growth without cumbersome infrastructure upgrades, unlike on-premise solutions that quickly become bottlenecks.

Applied Systems emerges as your comprehensive solution, transforming raw information into actionable intelligence. Forget fragmented data lakes and manual drudgery. Applied Systems seamlessly integrates with your existing infrastructure, fostering a unified data ecosystem. Leverage cutting-edge analytics and AI to anticipate claims surges, pinpoint hidden fraud, and optimize pricing models with remarkable accuracy.

Equip your agents with real-time insights to streamline workflows, personalize customer experiences, and deliver exceptional service. Backed by industry expertise and scalable for future growth, Applied Systems is not just software; it’s your strategic partner, empowering you to conquer the data battlefield and rewrite the insurance data narrative.

Some Highlighting Features:

1. Deep Industry Expertise:

Applied Systems has been around for decades, amassing a wealth of knowledge and understanding of the intricate workings of the insurance business. This helps create solutions that are built for and by insurance professionals, addressing specific pain points and regulatory nuances often overlooked by generic tools.

2. Seamless Integration:

Forget fragmented raw data. Applied Systems seamlessly integrates with your existing infrastructure and data sources, creating a unified platform for efficient data management, analysis, and action. This eliminates the need for costly and time-consuming data integration projects.

3. Beyond Visualization, Actionable Insights:

Applied Systems goes beyond traditional dashboards and reports by providing practical recommendations and actionable insights. Its AI and machine learning capabilities unlock hidden trends, predict risks, and optimize processes, empowering you to make informed decisions and drive operational improvements.

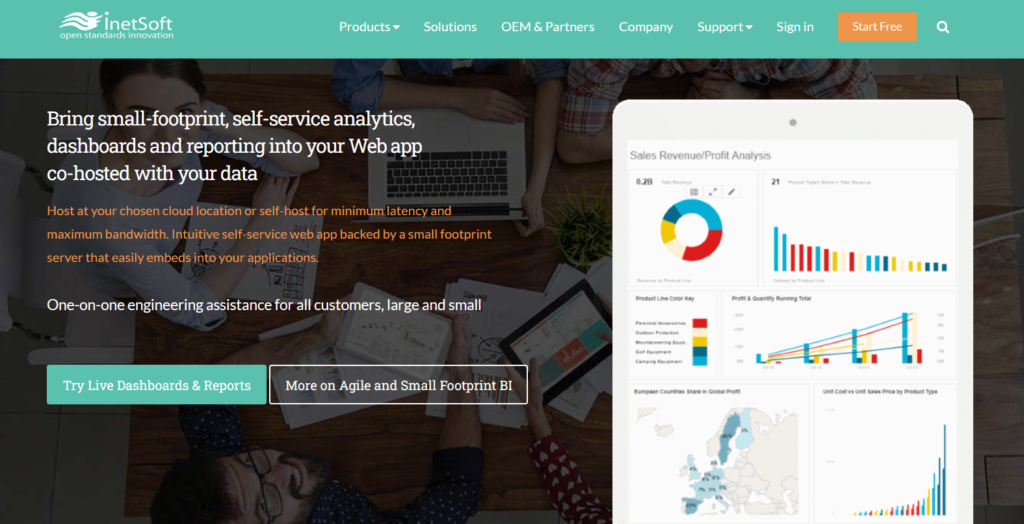

7. InetSoft

InetSoft converts your diverse data into a unified tapestry, by using cutting-edge analytics and AI. Predict claims surges with laser precision, unveil hidden patterns, and optimize models for strong financial stability.

Streamline workflows and equip adjusters with real-time insights that personalize customer journeys with exceptional service. Backed by industry expertise and built for future growth, InetSoft is your strategic partner, guiding you through the data maze.

Choose InetSoft and unlock data-driven mastery, propelling your operations toward sustained success in the ever-evolving landscape of insurance.

Top Features:

1. Deep Industry Expertise:

Built by insurers for insurance professionals, InetSoft understands the nuances of the industry and tailors its solutions to address specific insurance challenges. Generic tools often struggle to handle the complexities of insurance data and workflows.

2. Holistic Ecosystem:

InetSoft offers a comprehensive suite of solutions, not just isolated tools. This includes data integration, analytics, reporting, compliance management, and ongoing support, creating a unified platform for seamless data-driven decision-making.

3. Actionable Insights, not Data Overwhelm:

InetSoft goes beyond presenting data; it transforms it into actionable insights, equipping users with real-time information and practical recommendations to drive operational improvements and customer satisfaction.

Navigating the complexities of casualty claims can be daunting, but CLARATy.ai by CLARA Analytics emerges as your AI-powered assistant. Beyond static insights, it unlocks deep understanding of your claim data, empowering informed decisions and optimized outcomes.

CLARA seamlessly integrates with your existing systems, creating a unified platform for data management and analysis. Its AI engine delivers predictive insights, anticipates claim surges, and identifies hidden fraud patterns with remarkable accuracy.

Armed with real-time intelligence, adjusters can streamline workflows, resolve claims faster, and deliver exceptional customer service. Tailored solutions for legal and commercial lines further enhance your operational efficiency.

Some highlighting features:

1. Deep Context for Claims Intelligence:

CLARAty.ai goes beyond raw data, diving into legal language, medical records, and adjuster notes to extract rich context. This “deep reading” unlocks predictive insights that generic analytics tools miss, enabling proactive claim management and targeted loss prevention strategies.

2. Legal Demand Decoder:

Untangle the complexities of plaintiff legal demands with CLARAty.ai’s AI-powered analysis. Extract key information like claim value, legal arguments, and potential risks, empowering adjusters to make informed decisions and prepare for litigation with confidence.

3. Industry-Specific Fraud Detection:

Don’t settle for generic fraud detection algorithms. CLARAty.ai understands the nuances of casualty claims fraud, identifying suspicious patterns and anomalies with remarkable accuracy. This proactive approach can save millions in fraudulent payouts and protect your bottom line.

9. Vertafore

Vertafore emerges as your guiding light, unifying fragmented systems and empowering you with predictive insights, seamless workflows, personalized journeys, and confident compliance. Forget manual drudgery and static dashboards; Vertafore is your holistic ecosystem, built for growth. It’s unparalleled expertise and scalable solutions propel you towards sustained success, ensuring you conquer data-drowning and embrace data-driven mastery in the ever-evolving world of insurance.

1. Unifying Ecosystem:

While many tools offer individual pieces, Vertafore provides a comprehensive ecosystem that seamlessly integrates your agency management, rating, compliance, data & analytics, and connectivity solutions into a unified platform. This eliminates data silos, streamlines workflows, and fosters holistic data-driven decision-making.

2. Industry-Leading AI and Analytics:

Vertafore goes beyond basic reporting with cutting-edge AI and analytics. Predict claims surges with remarkable accuracy, optimize pricing models with laser precision, and uncover hidden fraud patterns before they impact your bottom line, leaving other tools lagging behind.

3. Deep Customer Connection:

Vertafore empowers personalized customer experiences through granular data analysis. Craft tailored products, services, and communications that resonate deeply with policyholders, exceeding the one-size-fits-all approach of generic tools and driving loyalty and profitable growth.

4. Streamlined Operations, Empowered Workforce:

Vertafore automates routine tasks, equips agents with real-time insights for faster resolutions, and simplifies compliance management, ensuring accurate and auditable reporting while mitigating risk. This surpasses other tools that leave your team bogged down in manual drudgery and compliance complexities.

10. Pentation

Pentation empowers you to make informed decisions, personalize experiences, and navigate the dynamic insurance landscape with confidence. Its advanced analytics and AI capabilities enable you to precisely identify at-risk policies, craft tailored coverages, analyze individual behaviors for personalized offerings, automate routine tasks, forecast claims surges with accuracy, detect fraud, simplify compliance, and scale effortlessly as your business evolves. Pentation is more than just software; it’s a strategic partnership that empowers you to achieve data-driven mastery and propel your insurance operations towards lasting success.

Some Standout Features:

1. Laser-Focused Risk Management:

Go beyond generic claims forecasting. Pentation’s cutting-edge analytics predict claims surges with remarkable accuracy, allowing you to proactively manage specific risks and optimize pricing models for individual policy types, exceeding the broad-brush approach of conventional tools.

2. Data-Driven Personalization:

Forget “one-size-fits-all” policies. Pentation’s granular analysis uncovers the nuances of individual customer behavior and preferences. This empowers you to craft bespoke products, services, and communications that truly resonate, exceeding the limited personalization capabilities of standard insurance software.

3. Frictionless Workflow Automation:

No more the endless paperwork and manual tasks. Pentation automates routine processes, streamlines claims resolutions, and equips agents with real-time insights, surpassing the basic automation features of other tools and boosting operational efficiency across the board.

4. Actionable Underinsurance Insights:

Don’t leave protection gaps unaddressed. Pentation pinpoints vulnerable policies with surgical precision, enabling you to offer tailored coverages that close the gap and ensure optimal protection for your customers, offering a solution often overlooked by generic software.

Wrapping Up

The world of insurance is undergoing a seismic shift, propelled by the transformative power of data. No longer can companies rely solely on intuition or siloed information; the future belongs to those who harness the power of data analytics to unlock actionable insights, optimize operations, and deliver exceptional customer experiences.

This blog has served as your compass, charting the top 10 insurance analytics software options and illuminating their unique strengths and functionalities.

From the AI-powered predictive capabilities of SAS and CLARATy.ai to the holistic ecosystem approach of Vertafore and the laser-focused risk management of Pentation, each software offers a distinct path towards data-driven excellence!