Leverage the Power of Atidot: Analytics for Insurance agencies

-

by LeadSendby LeadSend

November 16, 2023

November 16, 2023

Welcome to a new era in insurance, where data is the heartbeat of our industry, and understanding customers is at the core of impactful decision-making. Atidot, a trailblazer in InsurTech, is an innovative AI platform that goes beyond data analysis, offering a transformative experience for life insurance companies.

Let’s explore how Atidot, our trusted companion, not only analyzes data but intimately engages with you, and helps you generate insights that will grow your business.

What is Atidot?

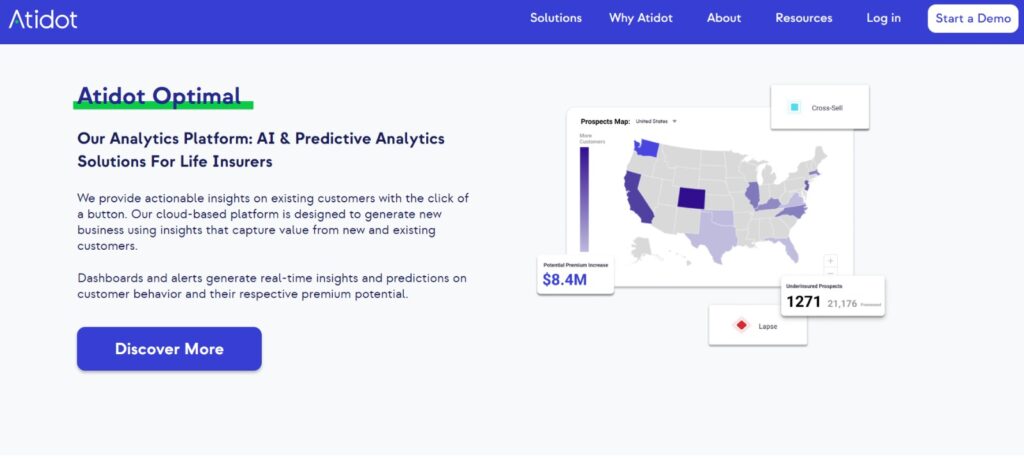

In the vast landscape of data, insurance companies often face challenges accessing valuable insights. Atidot serves as a guiding light in this journey, seamlessly blending internal and external data.

Born from the minds of data scientists, industry experts, and life actuaries, Atidot emerges as a reliable companion for life insurance and annuities companies. More than just a technological tool, Atidot becomes a trusted confidant, guiding insurers through the intricacies of data analytics.

The Magic of Data in Insurance:

We understand that insurance is about people, not just numbers. Atidot transforms your data into a compelling narrative that is not only accurate but also insightful. Real-world examples showcase how Atidot empowers you to make informed decisions, revamp underwriting processes, and assess risk with a precision that surpasses traditional analytics.

Analytics for Risk Assessment:

Risk is a constant companion in insurance, and Atidot’s platform becomes your trusted ally in navigating uncertainty. Predictive analytics tools identify and mitigate risks, offering a deeper understanding of your policyholders. See how this technology reshapes risk analysis for actuaries, providing precise reports that reflect the dynamic nature of the industry

Multipurpose Tool

Atidot makes a real difference across the entire life insurance world, benefiting everyone involved.

– Executives

Leadership sees Atidot as a trusted ally for business growth through data-driven decisions. By boosting the profitability of existing portfolios, Atidot empowers executives to guide their companies towards lasting success.

– Marketers:

Atidot’s innovative AI platform provides marketers with a wealth of insights to tailor their strategies effectively. By understanding customer behaviors and preferences, marketers can create targeted campaigns that resonate with the audience.

Atidot doesn’t just stop at analyzing historical data; it anticipates trends and helps marketers stay ahead of the curve.

– Policy Distributors

For those responsible for distributing insurance policies, Atidot streamlines the process by providing a comprehensive view of customer profiles and risk factors. This allows policy distributors to offer tailored solutions that align with individual needs and risk tolerance.

The platform’s predictive analytics further helps in identifying potential gaps in coverage, enabling distributors to proactively address client concerns.

– Actuaries

At the heart of insurance, actuaries rely on precise data to make accurate predictions and set premium rates. Atidot revolutionizes actuarial processes by offering a dynamic and responsive analytics platform.

Actuaries can harness the power of predictive modeling to assess risk with a level of precision previously unattainable. The platform adapts to changing market dynamics, ensuring that actuaries have real-time insights to make data-driven decisions.

Atidot’s New AI Platform

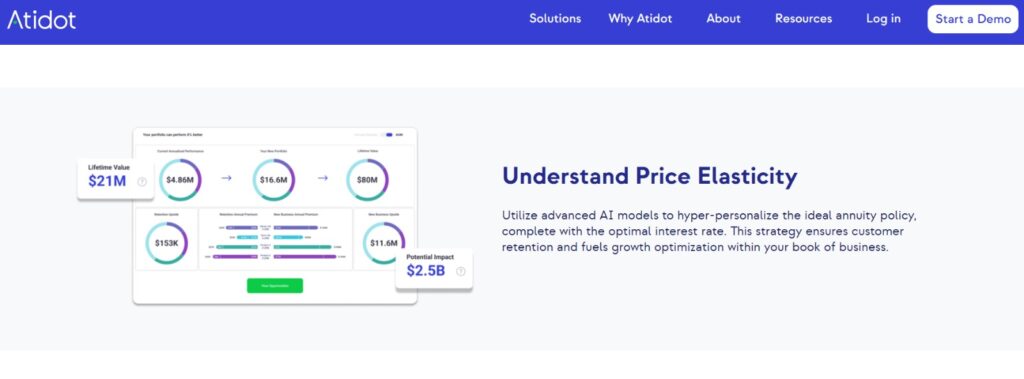

Atidot has just launched an innovative AI platform, and it’s a game-changer for the insurance industry. Packed with advanced features, this platform is a pioneer, offering a unique ability to suggest personalized insurance products for each policyholder. It’s not just about data analysis; it’s a tool that helps insurers better understand their customers and boost sales.

“We are excited to launch our new platform, which is packed with advanced features that will empower insurers to understand their policyholders better and optimize their engagement strategies,” said Dror Katzav, CEO of Atidot. “Our platform is designed to help insurers thrive even in today’s volatile market, providing them with the tools they need to make data-driven decisions and achieve sustainable growth.”

“We are using advanced AI technology to bring life insurance and annuities into the modern era. Our automated platform streamlines the entire process from beginning to end, making it easy for insurers to deliver better service, achieve full personalization, and grow their revenue,” says Eyal Bar-Noy, Atidot Vice President of Engineering.

Atidot’s Product Palette

Atidot’s product palette goes beyond analytics, offering insurers a unique tool to suggest tailored products for individual policyholders.

This feature analyzes diverse data points to understand each policyholder’s needs, allowing insurers to paint a personalized landscape of offerings.

It’s not just about data; it’s a strategic shift toward customer-centricity, enhancing satisfaction, loyalty, and potential for increased sales.

Final Words

In this new era of insurance, Atidot is your trusted partner, reshaping the industry with its AI platform. It turns your data into insights, guiding your decisions and redefining risk assessment.

Whether you’re an executive seeking lasting success, a marketer tailoring strategies, or an actuary optimizing accuracy, Atidot is here for you.